Estimated salvage value

Leader in online salvage insurance auto auctions. Declining Balance Method.

Residual Value Definition Example Calculate Residual Value

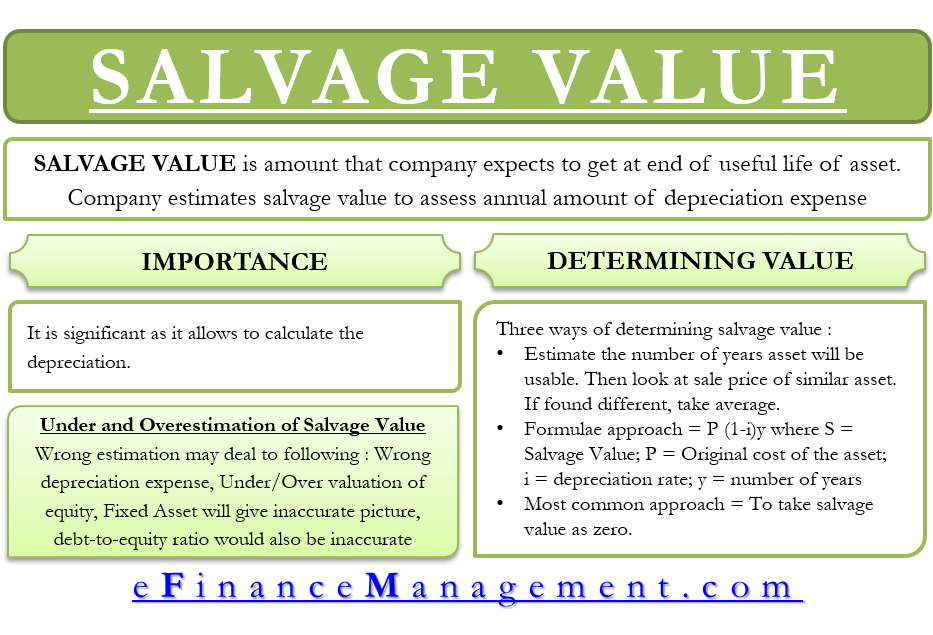

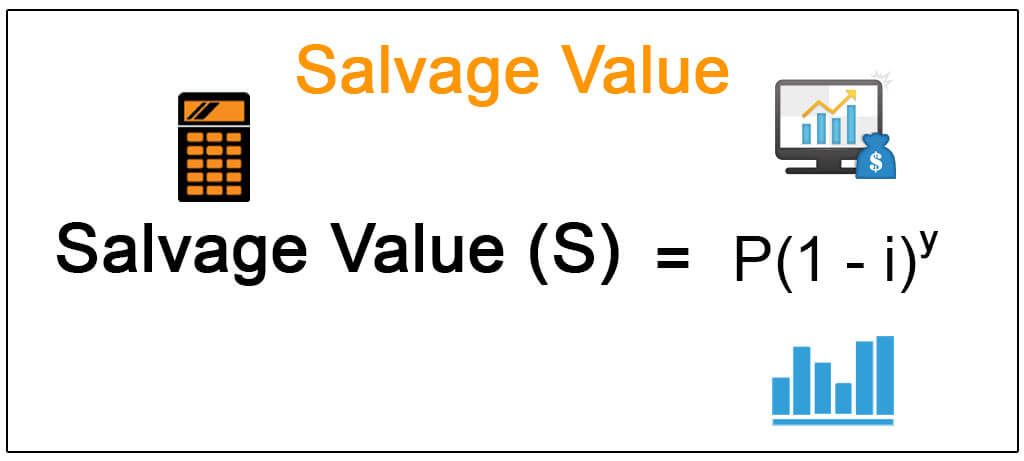

Salvage value is the estimated value that the owner is paid when the item is sold at the end of its useful life.

. A business owner should ignore salvage value when the business itself has a short life expectancy the asset will last less than one year or it will have an expected salvage value of zero. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. Section 179 deduction dollar limits.

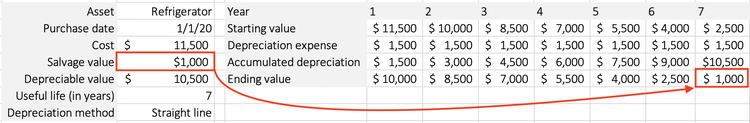

Well use a salvage value of 0 and based on the chart above a useful life of 20 years. Once you have that subtract 5 from the depreciation price for every year you have owned the mobile home. The company estimates that the computers useful life is 4 years.

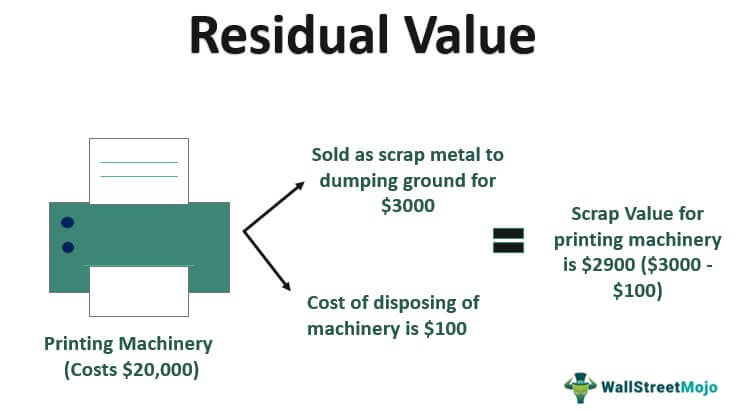

The meaning of SALVAGE VALUE is the value of damaged property. Residual value estimated salvage value cost of asset disposal In this way the residual value is how much salvage value is expected to remain in the property minus how much it may cost to dispose of or get rid of the asset. The amount of the award depends on in part the value of the salved vessel the degree of risk involved and the degree of peril the vessel was in.

Get 247 customer support help when you place a homework help service order with us. See My Options Sign Up. Vehicles with less than 65 percent damage are not considered salvage.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. The residual value of a fixed asset is an estimate of how much it will be worth at the end of its lease or at the end of its useful life. The actual or estimated value realized on the sale of a fixed asset at the end of its useful life.

21500 0 20 years 1075 annual depreciation. 100000 total loss clean title used cars trucks SUVs fleet vehicles. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

100000 total loss clean title used cars trucks SUVs fleet vehicles. The result would look something like this. The lessor uses residual value as one of.

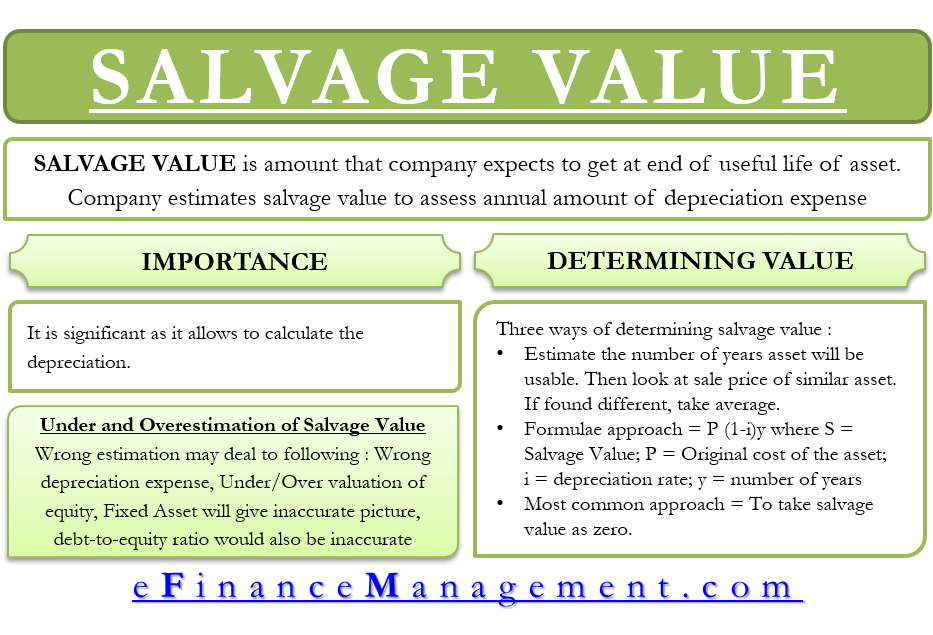

Salvage value is used in calculating depreciation. Dictionary Entries Near salvage value. This means that the computer will be used by Company A for 4 years and then sold afterward.

NY - SYRACUSE. Leader in online salvage insurance auto auctions. FL - TAMPA SOUTH - - SR001.

Salvage value can often be calculated using comparable assets in the market. For instance if you have a. The estimated salvage value is deducted from the cost of the asset to determine the total depreciable amount of an asset.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Sold in the USA internationally. Any vehicle which has been wrecked destroyed or damaged to the extent that the total estimated or actual cost of parts and labor to rebuild or reconstruct the vehicle to its pre-accident condition and for legal operation on roads or highways exceeds a jurisdiction-defined percentage of the retail value of the vehicle.

If a business estimates that an assets salvage value will be minimal at the end of its life it can depreciate the asset to 0 with no salvage value. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

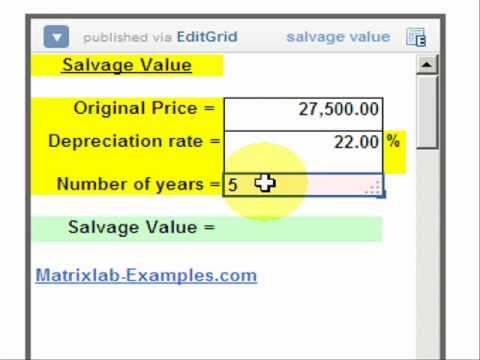

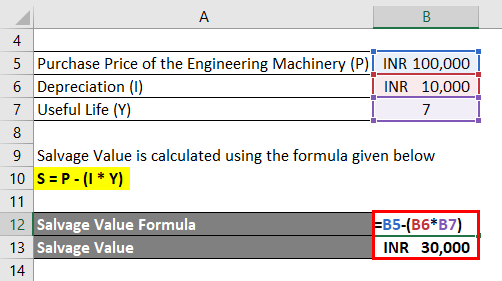

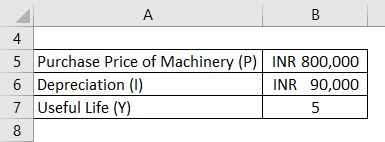

Here well calculate the residual value of a piece of manufacturing equipment. Lets take 5000 as the estimated salvage value of the. To calculate the depreciation value per year first calculate the sum.

C 3034 P050. Auction in 6D 23H. Salvage value is the estimated resale value of an asset at the end of its useful life.

For example if the machinery of a company has a life of 5 years and at the end of 5 years its value is. Thus salvage value is used as a component of the depreciation calculation. The value is used to determine annual depreciation in the accounting records and.

Total Loss - A vehicle that has been damaged to the extent that the estimated cost of repair not including the cost associated with painting any part of the vehicle would exceed 65 percent of the fair market value of the vehicle immediately before the damage was incurred. Sold in the USA internationally. The market value will be 17000 if the home is unfurnished and 14400 if the home is furnished.

The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. If we apply the equation for straight line depreciation we would subtract the salvage value from the cost and then divide by the useful life. Keep scrolling for more.

For instance If you have lived in your mobile home for two years the value has depreciated by 10. For example Company A purchases a computer for 1000. Traffic collisions often result in injury disability death and property damage as well as financial costs to both society and the individuals involved.

Take that the manufacturing equipment cost 40000 and say the useful life is estimated at eight years. Auction in 0D 10H. What is Salvage Value.

Salvage value or Scrap Value is the estimated value of an asset after its useful life is over and therefore cannot be used for its original purpose. Residual value estimated salvage value cost of asset disposal Residual Value Example. For example company B buys a production machine for 10000 with a useful life of five years and a salvage value of 1000.

Salvage may encompass towing re-floating a vessel or effecting repairs to a ship. Marine salvage is the process of recovering a ship and its cargo after a shipwreck or other maritime casualty. Lets go back to the 20000 example.

Book value attempts to approximate the fair market value of a company while salvage value is an accounting tool used to estimate depreciation. A traffic collision also called a motor vehicle collision car accident or car crash occurs when a vehicle collides with another vehicle pedestrian animal road debris or other stationary obstruction such as a tree pole or building. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated.

Salvage Value Calculation Youtube

How To Calculate Book Value 13 Steps With Pictures Wikihow

What Is The Difference Between A Salvage Value And A Scrap Value Quora

How To Determine An Asset S Salvage Value

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Accountingcoach

Salvage Value Formula And Example Calculation Excel Template

Salvage Value Meaning Importance How To Calculate

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value A Complete Guide For Businesses

Salvage Value Formula And Example Calculation Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template